New Help to Buy scheme opens to applications in December

The government has announced that the new Help to Buy Equity Loan scheme in England, which is due to begin in April 2021, will be open to new applications from the 16th of December.

This may come as good news for first-time buyers struggling to save up for a deposit of more than 10%, at a time when mortgages with a loan-to-value higher than 85% are hard to find.

The new scheme, which is replacing the current one, is set to run for two years, until March 2023.

Here’s a quick overview of what it is, and who it’s for.

What is the Help to Buy Equity Loan scheme?

Back in 2013, as a way to help more people get on to the property ladder, the government launched a scheme which makes it possible for buyers to buy a home with as little as a 5% deposit.

Close to 300,000 new homes were bought using the scheme in the seven years since its launch, and as it comes to an end, the government has created a new, and similar, one to replace it.

If you’re eligible for the scheme, and can prove you have enough saved to cover a 5% deposit, the government will provide a low-interest loan of 20% of the house price (or up to 40%, if you’re in London), and the mortgage provider will lend the remaining balance.

The government loan is interest-free for the first five years. After that, a monthly interest fee of 1.75% will apply, and will increase each year in April in line with the Consumer Price Index (CPI), plus 2%.

Who’s eligible for it?

The new scheme is only available if you meet all of the following requirements:

- You’re a first-time buyer. You – and your partner, if you’re married or in a civil partnership – must not own, or have previously owned, any property or residential land in the UK or abroad.

- You are purchasing a newly built home. And you’ll have to make sure you’re buying the property off an approved developer who is registered with the scheme.

- The property must be your only property and your permanent residence.

- You can demonstrate you have a minimum deposit of 5% of the property’s purchase price, and that you have the means to keep up with the monthly mortgage and Equity Loan repayments.

Is there a limit to the price of the property I can buy using the scheme?

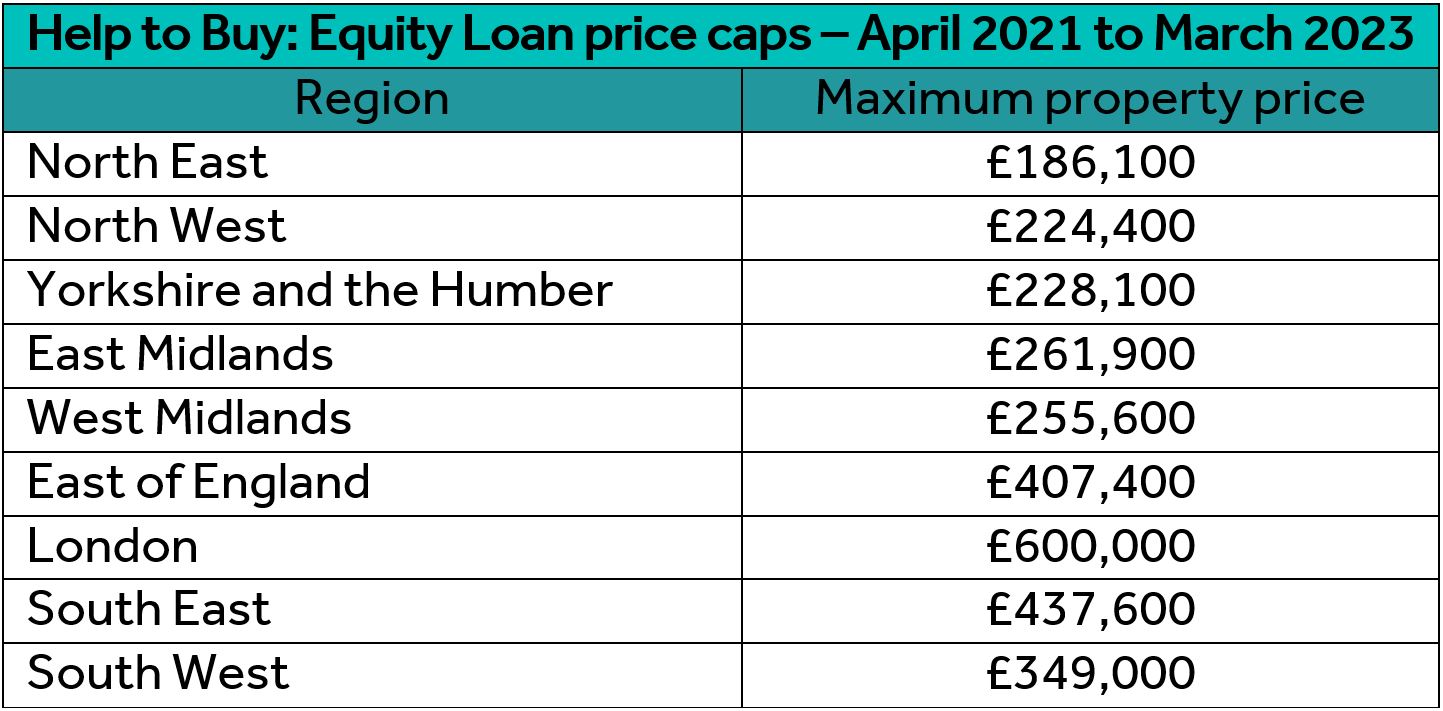

Yes, the government has introduced price caps for each region in England, so the maximum property price will depend on where you are buying.

There are the new regional price caps:

If you are considering selling or letting your property in Ashtead, Leatherhead, Fetcham, Epsom, Bookham or the surrounding areas, call V&H Homes on 01372 221 678